How do online casinos prevent money laundering? Well, it’s a fascinating topic that merges the worlds of finance and gambling. You see, online casinos are not only responsible for providing a fun and entertaining experience, but they also have a duty to ensure that their platforms are not utilized for illegal activities. Money laundering is a significant concern, and online casinos have implemented stringent measures to prevent it.

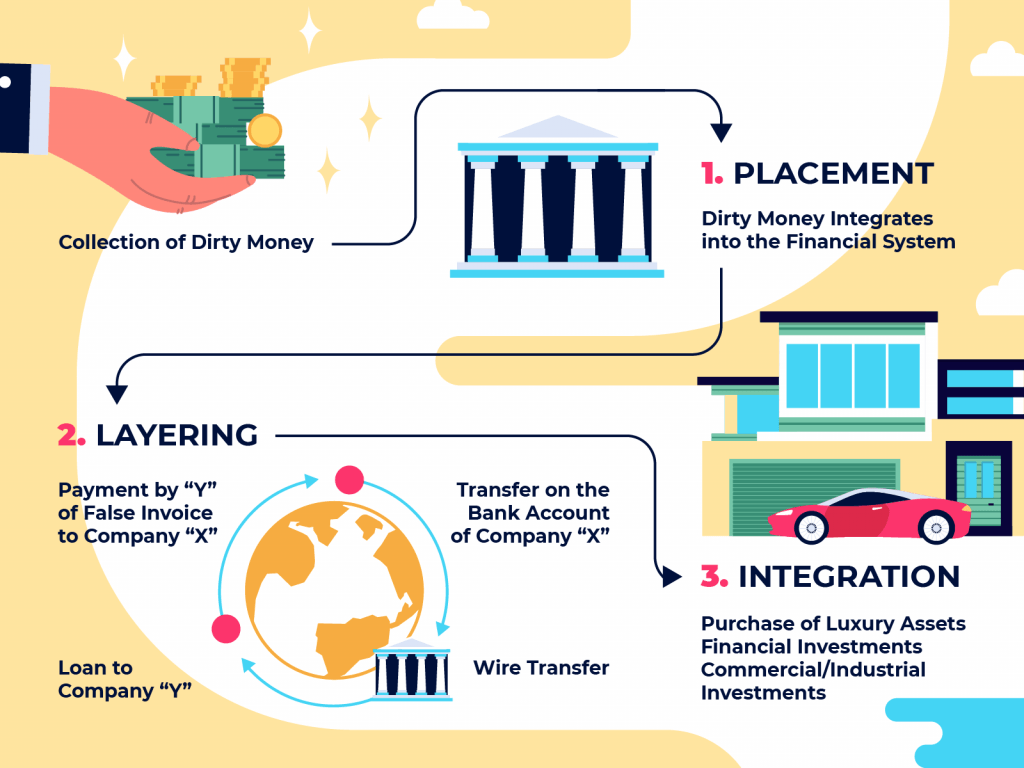

Now, you might be wondering, “What exactly is money laundering?” Money laundering is the process of making illegally obtained money appear legal by disguising its true origin. Criminals do this to avoid detection by law enforcement and to integrate their ill-gotten gains into the legitimate financial system. It’s like trying to hide a trail of breadcrumbs to cover up a misdeed.

So, how do online casinos tackle this issue? They employ a variety of techniques and technologies to detect and prevent money laundering. From robust identity verification procedures to transaction monitoring systems, online casinos leave no stone unturned to ensure that their platforms are not used for illicit financial activities. And that’s precisely what we’ll explore further in this article. So, let’s dive in and uncover the strategies behind preventing money laundering in online casinos!

Online casinos employ several strategies to prevent money laundering. These include implementing strict identity verification processes, monitoring financial transactions for suspicious activity, and collaborating with financial institutions to share information. Additional measures include adhering to regulatory requirements and conducting regular internal audits. By employing these multifaceted measures, online casinos create a secure environment that safeguards against money laundering and ensures the integrity of their operations.

How Do Online Casinos Prevent Money Laundering?

Online casinos have become increasingly popular in recent years, offering players the convenience and excitement of gambling from the comfort of their own homes. However, with this rise in popularity comes the need for strict regulation and measures to prevent money laundering. In this article, we will explore the various ways in which online casinos prevent money laundering and ensure a safe and secure gambling environment for their players.

Regulatory Framework and Compliance

One of the primary ways in which online casinos prevent money laundering is through the establishment of a robust regulatory framework and strict compliance with anti-money laundering (AML) laws and regulations. Online casinos are required to obtain proper licensing from reputable jurisdictions, such as the United Kingdom Gambling Commission or the Malta Gaming Authority. These regulatory bodies have stringent standards in place to ensure that casinos adhere to AML protocols, including thorough customer due diligence measures and monitoring of financial transactions.

To comply with AML regulations, online casinos implement stringent know-your-customer (KYC) procedures. This involves verifying the identity and age of players, as well as conducting background checks to detect any suspicious financial activities. By implementing these measures, online casinos can establish a strong foundation for preventing money laundering and other illicit activities.

Additionally, online casinos are required to maintain adequate records of all customer transactions, including deposits, withdrawals, and any suspicious activities. These records are regularly audited to ensure compliance with AML laws and regulations. By maintaining transparent and accurate records, online casinos can effectively track and monitor financial transactions to identify and prevent money laundering.

Technological Solutions and Data Analysis

Online casinos rely on advanced technological solutions to detect and prevent money laundering activities. They employ sophisticated systems and tools that use artificial intelligence (AI) algorithms and data analysis techniques to analyze customer behavior and financial transactions in real-time. These systems can detect patterns and anomalies that may indicate potential money laundering activities.

Through the use of these technological solutions, online casinos can flag suspicious transactions for further investigation. This allows them to take immediate action to prevent the laundering of illicit funds. For example, if a player suddenly deposits a large sum of money and immediately requests a withdrawal without engaging in any significant gameplay, this behavior may trigger an alert and prompt the casino to investigate further.

Furthermore, online casinos collaborate with financial institutions, such as banks and payment service providers, to monitor and verify financial transactions. They share information, such as customer identification details and transaction records, to enhance the effectiveness of their AML efforts. By leveraging these collaborative efforts and technological solutions, online casinos can stay one step ahead in the fight against money laundering.

Education and Staff Training

An essential aspect of preventing money laundering in online casinos is staff education and training. Casinos provide comprehensive training programs to employees, particularly those working in customer support, financial departments, and compliance. These programs educate staff members on the signs of money laundering and how to identify and report suspicious activities.

By equipping employees with knowledge and training, online casinos create a strong line of defense against money laundering. Staff members are trained to conduct thorough due diligence on customers, review financial transactions for any irregularities, and report any suspicious activities to the appropriate authorities. Regular training sessions and refresher courses ensure that staff members are up-to-date with the latest AML regulations and best practices.

In addition to training staff, online casinos also educate their players about money laundering and its consequences. They provide information on how to gamble responsibly, avoid illegal activities, and report any suspicious behaviors they may encounter. By promoting awareness and responsible gambling, online casinos empower their players to play a role in combating money laundering.

Effective Measures and Ongoing Efforts

Collaboration with Law Enforcement

Online casinos understand the importance of collaboration with law enforcement agencies in preventing money laundering. They work closely with local authorities and international law enforcement organizations to share information, identify trends, and cooperate in investigations. By exchanging intelligence and insights, online casinos and law enforcement agencies can collectively combat money laundering and ensure a secure gambling environment.

Continuous Monitoring and Auditing

Online casinos are constantly evolving their AML measures to adapt to new threats and emerging trends in money laundering. They regularly conduct internal and external audits to assess the effectiveness of their policies and procedures. This ongoing monitoring and auditing process help identify any weaknesses or gaps in the existing system and allows online casinos to implement necessary improvements.

Public-Private Partnerships

Public-private partnerships play a crucial role in the prevention of money laundering in online casinos. Governments and regulatory bodies collaborate with online casinos and other stakeholders to develop and implement effective AML measures. By working together, they can leverage their respective resources and expertise to create a comprehensive approach to combat money laundering.

Conclusion

Preventing money laundering is a top priority for online casinos. Through strict regulatory compliance, the use of advanced technological solutions, staff education and training, collaboration with law enforcement, continuous monitoring, and public-private partnerships, online casinos ensure a safe and trustworthy gambling environment for their players. By implementing these measures and staying vigilant in the ongoing fight against money laundering, online casinos contribute to the overall integrity of the gambling industry.

Key Takeaways: How Do Online Casinos Prevent Money Laundering?

- Online casinos implement strict know-your-customer (KYC) procedures to verify the identity of players.

- They monitor transactions for any suspicious activity, such as unusually large deposits or withdrawals.

- Online casinos maintain transaction records and report any suspicious transactions to the authorities.

- They use advanced fraud detection systems to identify patterns that may indicate money laundering.

- Online casinos work closely with regulatory bodies to ensure compliance with anti-money laundering laws.

Frequently Asked Questions

Welcome to our frequently asked questions section on how online casinos prevent money laundering. We understand that this is an important topic and we’re here to provide you with answers that are easy to understand and comprehensive. Read on to find out more.

1. How do online casinos verify the identity of their players?

Online casinos take several measures to verify the identity of their players and prevent money laundering. Firstly, they require players to provide personal identification documents such as a passport or driver’s license. These documents are thoroughly checked to ensure their authenticity. Additionally, online casinos may use third-party identity verification services which can verify personal information against public records and databases. This helps to ensure that players are who they claim to be.

Furthermore, online casinos may implement a Know Your Customer (KYC) process which involves additional checks such as address verification and proof of income. By thoroughly verifying the identity of their players, online casinos can effectively prevent money laundering and maintain a safe and secure environment for all.

2. How do online casinos monitor and report suspicious activities?

Online casinos have robust systems in place to monitor and detect suspicious activities. They use advanced fraud detection tools and algorithms that analyze player behavior and transactions in real-time. These systems can flag any unusual patterns, such as large amounts of money being deposited and withdrawn within a short period of time, or multiple accounts being linked to a single user.

If suspicious activity is detected, online casinos have an obligation to report it to the relevant authorities. They work closely with regulatory bodies and law enforcement agencies to share information and cooperate in investigations. Online casinos take money laundering very seriously and do everything in their power to prevent it from happening on their platforms.

3. Do online casinos keep a record of player transactions?

Yes, online casinos keep a detailed record of player transactions for multiple reasons. One of the main reasons is to comply with anti-money laundering regulations. By keeping a record of all deposits and withdrawals, online casinos can demonstrate transparency and accountability.

These transaction records can also be used for internal auditing purposes and to resolve any disputes that may arise between the casino and a player. It’s important to note that online casinos follow strict data protection protocols to ensure the confidentiality and security of these records.

4. What policies do online casinos have in place to prevent money laundering?

Online casinos have comprehensive policies and procedures in place to prevent money laundering. These policies often include robust customer due diligence measures, such as identity verification and screening against international sanctions lists. They also implement transaction monitoring systems to detect and report any suspicious activities.

In addition, online casinos may have strict limits on deposits and withdrawals to prevent the movement of large sums of money. They may also require players to use payment methods that have been verified by the casino. By implementing these policies, online casinos create a secure and responsible gambling environment that is hostile to money laundering activities.

5. How are cryptocurrencies regulated in online casinos to prevent money laundering?

The use of cryptocurrencies in online casinos is subject to regulations and compliance measures aimed at preventing money laundering. Online casinos that accept cryptocurrencies often require players to undergo the same KYC process as those using traditional payment methods.

Additionally, online casinos may ask players who use cryptocurrencies to provide proof of ownership and the origin of the digital assets. By implementing these measures, online casinos ensure that cryptocurrencies are not being used to launder money and maintain a safe and transparent gaming experience.

SGC 2020: AI for Anti-Money Laundering in Online Gambling

Summary

Online casinos take measures to prevent money laundering and keep players safe. They use identity verification, transaction monitoring, and reporting suspicious activities. This helps maintain a secure and fair gambling environment for everyone involved. It’s important to choose reputable online casinos that prioritize safety and adhere to regulations to protect players from financial crimes. Remember to gamble responsibly and have fun in a safe and secure online environment.